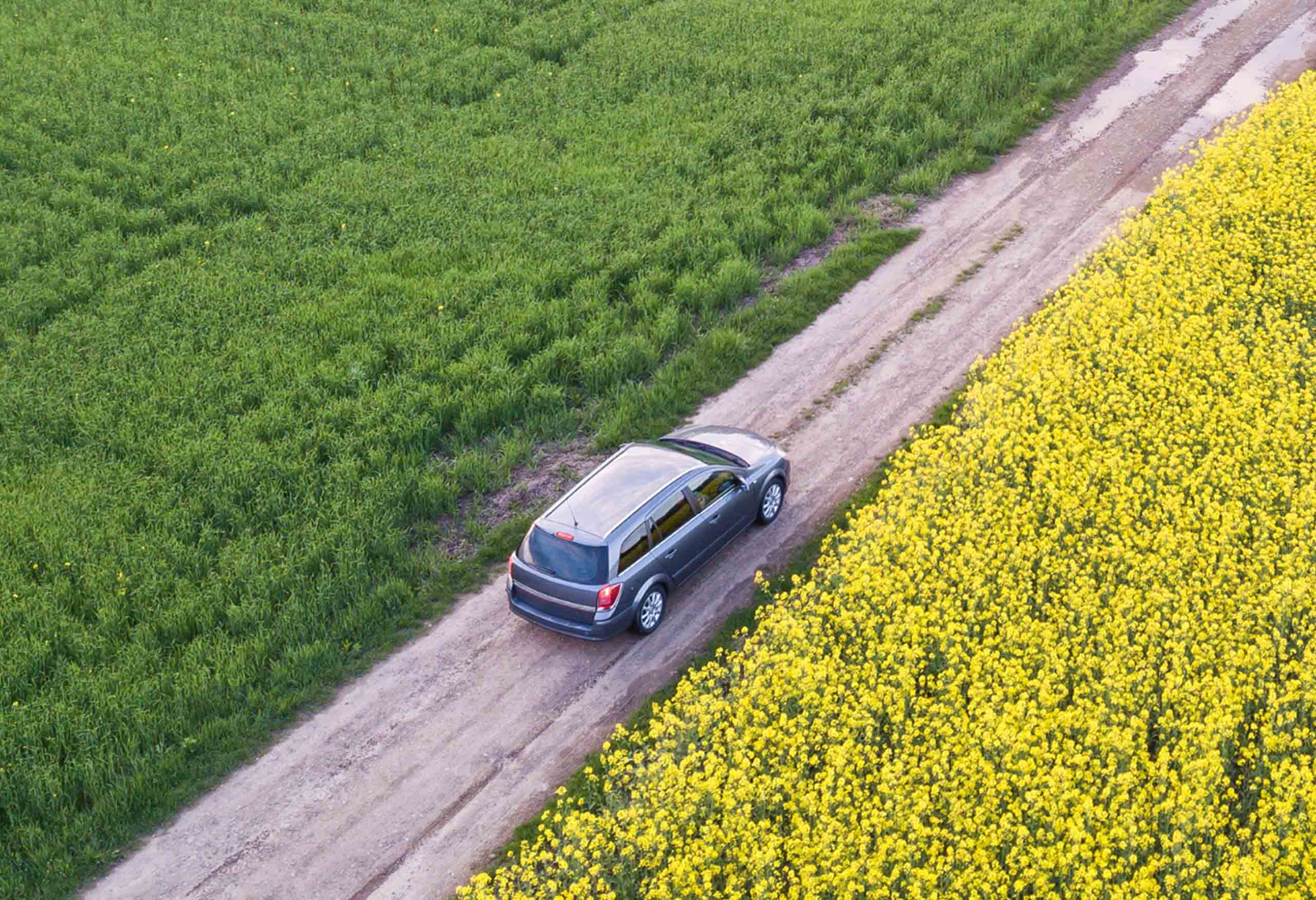

Auto Insurance

Why Do You Need Auto Insurance?

Auto insurance helps to cover drivers from accidents that involve their cars, trucks, motorcycles, and other vehicles. This type of insurance can cover individual drivers or families with multiple drivers and multiple vehicles. Auto insurance coverage is available to protect against financial loss that would occur from physical damage to the vehicle. It can also provide coverage for bodily injury to the insured members or other drivers, as well as other types of liability that may result from an auto accident.

Depending on the type of auto insurance a driver has, coverage may include financial loss from any theft or property damage to the vehicle. If the insured driver was responsible for an auto accident, appropriate auto insurance can cover the costs of vehicle damage or bodily injuries to other drivers as well.

When the insured driver or other drivers are injured, auto insurance can help to pay for mounting medical bills. In some cases, auto insurance will help to cover lost wages faced by injured individuals who are unable to work because of their injuries. In the event of death from an auto accident, it may also help to cover funeral expenses to provide relief for family members.

Not only is auto insurance essential for protecting drivers from the hazards of the road, it’s also required by every state. Each state has certain minimum requirements for the types of auto insurance needed for drivers. If you’re unsure of the legal requirements for your vehicle, we can help. Let us evaluate your unique driving needs, habits, and risks to determine the optimal auto insurance policy for you.

Collision Insurance

Collision coverage pays for damage caused to your vehicle in an automobile accident. Standard collision coverage will pay for any repairs up to the fair market value of your car. Collision coverage usually also comes with an insurance deductible. It’s the amount of money you pay toward repairs before your collision insurance kicks in. The higher the deductible you’re willing to pay, the less the collision coverage will cost.

Comprehensive Insurance

Comprehensive insurance covers damage done to your car in some way other than a collision, such as if it were stolen or vandalized. Flood, hurricane, theft, windshield damage and fire are also events usually covered by comprehensive car insurance. Like collision, comprehensive will pay up to the fair market value of your car (less your insurance deductible.) Although it’s not legally required by any state, you will probably need it if your car is financed.

Quotes Are Quick And Easy!

The Murphy Insurance Group

14 Storrs Avenue

Braintree, MA 02184

Phone: (781) 380-0599

Fax: 781-380-0686

Hours

Monday - Friday: 8:30AM - 4:30PM

We are licensed in Massachusetts, Florida, Maine, New Hampshire, New Jersey, New York, Rhode Island, Vermont, Connecticut, and Maryland.

"Insurance since 1908.

Put our experience to work for you."